crypto tax calculator australia free

Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. Australias Leading Crypto Tax Tool.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Sign up for our free trial get a feel for the application then send us an email to get.

. Here is an example. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year.

Not sure how cryptocurrencies are taxed. A record of all crypto purchases sales and interest earned. Here is a list of things you need before you lodge your crypto tax return with Etax.

Capital gains tax report. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. Aggregate Your Exchange Data.

Dont have an account. If you make profit on a transaction then youll need to pay tax on your capital gain. Check out our free and comprehensive guide to crypto taxes in.

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Australian Cryptocurrency Record Keeping Made Simple.

This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. A capital gains event only occurs when you do something with your crypto. If you only buy and hold then you dont need to pay tax on your crypto even if the value of your purchased coins has increased.

Link trades using FIFO LIFO HCFO or a custom method. Rated 46 with 700 Reviews. Crypto tax breaks.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Calculate Your Crypto DeFi and NFT Taxes in Minutes. If he were to sell his BTC and cash out he would have to pay taxes on A7000 A12000 A5000 of capital gains.

Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to crypto too. As an accountant whether you see crypto clients on a regular basis or once in a blue moon Crypto Tax Calculator Australia is here for all your crypto tax needs. Ideally you should download a crypto tax report from your provider.

2019 - 2022 Crypto_Tax. We use this to. You can discuss tax scenarios with your accountant.

June 27 2022. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

Over 600 Integrations incl. Youll only start to pay Income Tax when you hit 18200 in total income per year. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

You simply import all your transaction history and export your report. Selling cryptocurrency for fiat currency eg. Our platform allows you to import transactions from more than 450 exchanges and blockchains today.

It has full integration with popular Australian exchanges wallets to import your. Australian citizens have to report their capital gains from cryptocurrencies. You buy 1 bitcoin at 10000.

Compliant with Australian tax rules. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Australian Dollars triggers capital gains tax.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year. Quick simple and reliable.

File your crypto taxes in Australia. 1 BTC is now worth A12000. Get Started For Free.

Free Trial Up to 50 Transactions 0 Financial Year. Crypto Tax Calculator who we recommend for our existing users. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets. Although the popular exchange and payment platform didnt reveal which jurisdiction is next they will likely focus on where the majority of.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

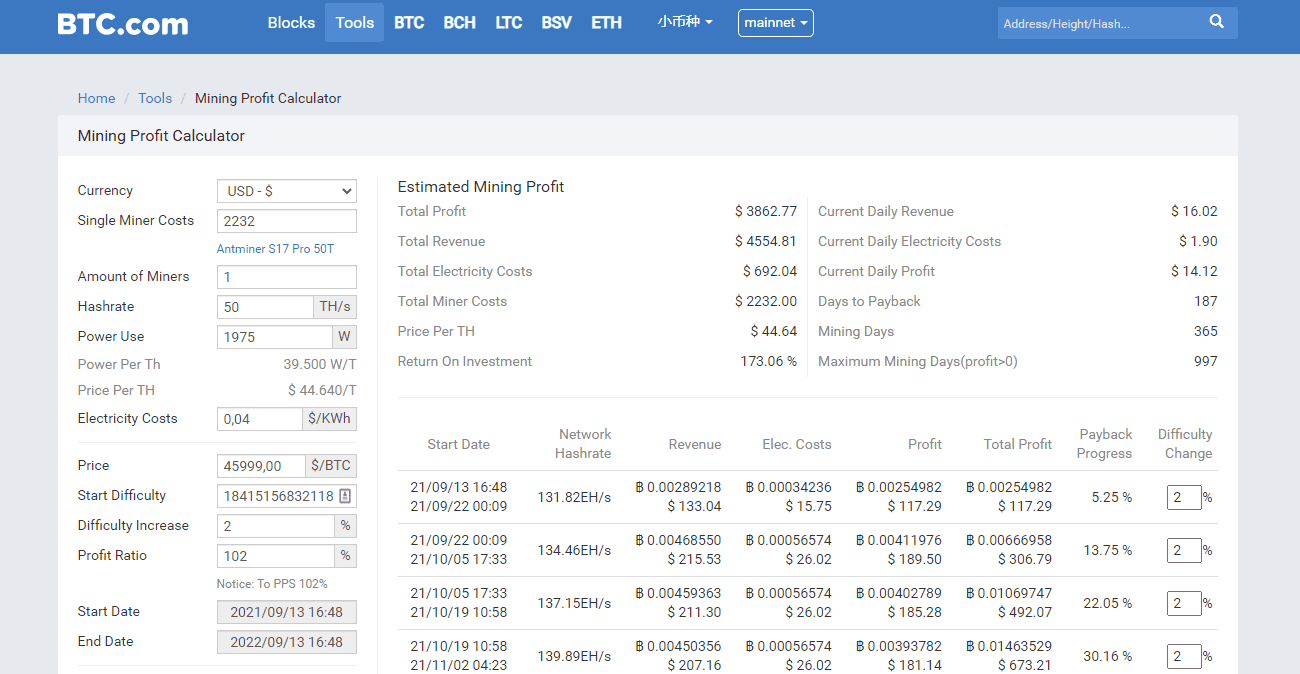

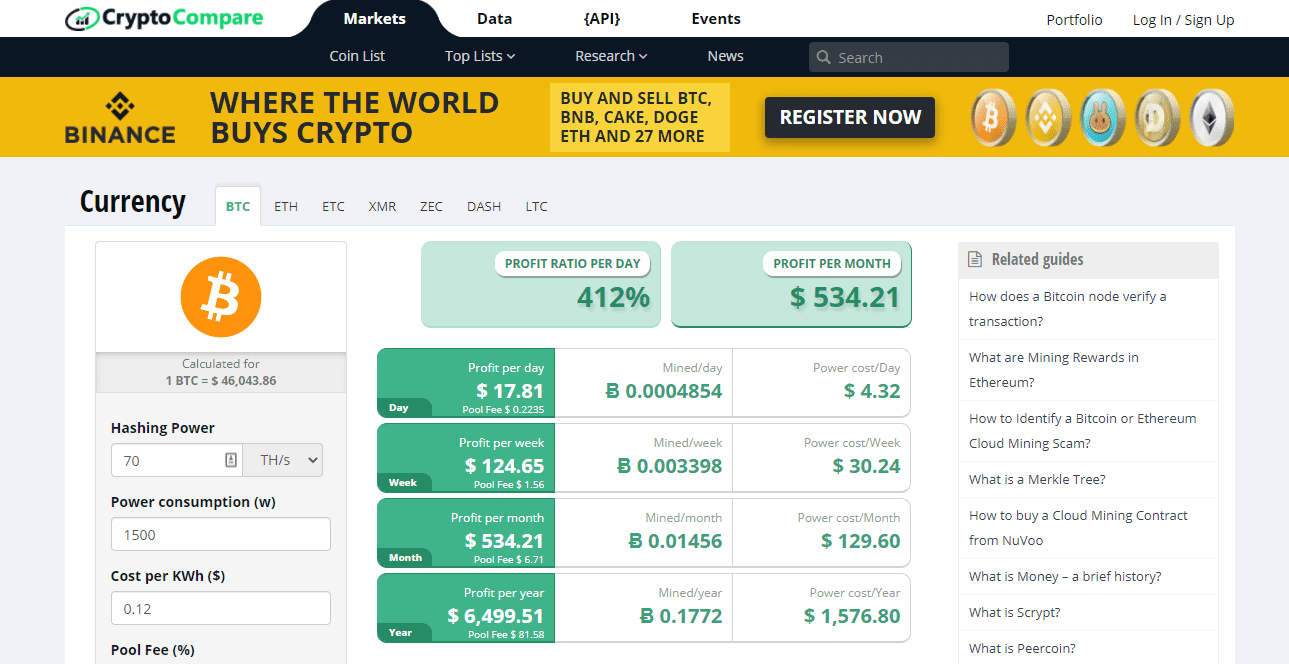

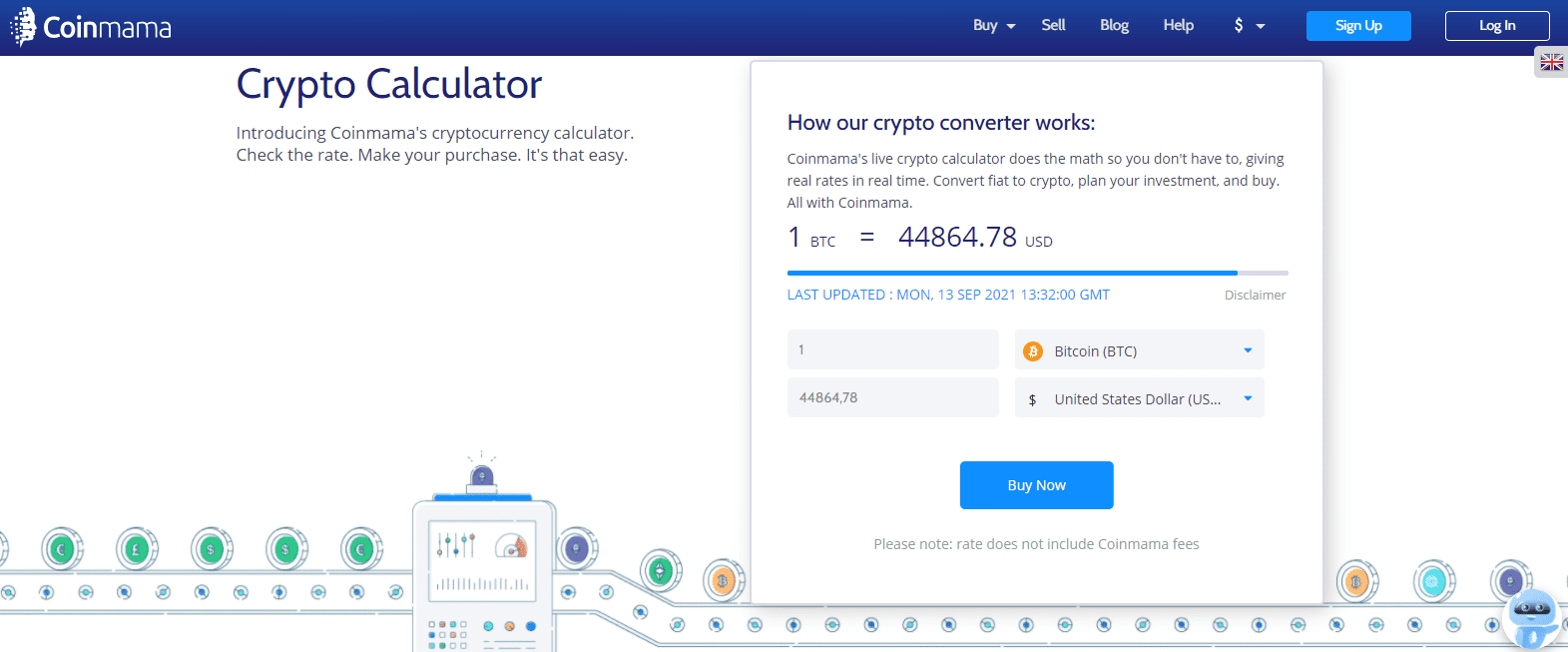

Best Cryptocurrency Calculator Mining Profit Taxes

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax In Australia The Definitive 2021 2022 Guide

Best Cryptocurrency Calculator Mining Profit Taxes

Best Cryptocurrency Calculator Mining Profit Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Cryptoreports Google Workspace Marketplace

How To Calculate Crypto Taxes Koinly

Best Crypto Tax Software Top Solutions For 2022

Best Cryptocurrency Calculator Mining Profit Taxes

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin